iowa transfer tax calculator

This Calculation is based on 160 per thousand and the first 500 is exempt. Calculate the real estate transfer tax by entering the total amount paid for the property.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Total Amount Paid Must be 99999999 Rounded Up to Nearest 500 Increment - Exemption.

. Calculate the real estate transfer tax by entering the total amount paid for the property. 2022 Chickasaw County Iowa. You can also find the total amount paid by entering the revenue tax stamp paid.

Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt.

Returns either Total Amount Paid or Amount Due. This calculation is based on 160 per thousand and the first 50000 is exempt. Iowa Real Estate Transfer Tax Calculator.

This calculation is based on 160 per thousand and the first 500 is exempt. You can also find the total amount paid by entering the revenue tax stamp paid. You can also find the total amount paid by entering the revenue tax stamp paid.

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. This calculation is based on 160 per thousand and the first 500 is exempt. Returns either Total Amount Paid or Amount.

Click anywhere outside that box or press the Tab Key for the result. The calculation is based on 160 per thousand with the first 500 being exempt. You can also find the total amount paid by entering the revenue tax stamp paid.

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate. This calculation is based on 160 per thousand and the first 500 is exempt. Calculate the real estate transfer tax by entering the total amount paid for the property.

Type your numeric value in either the Total Amount Paid or Amount Due boxes. The tax is paid to the county recorder in the county where the real property is located. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

You can also find the total amount paid by entering the revenue tax stamp paid. Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid. Transfer Tax Calculator Iowa Real Estate Transfer Tax Description.

Real Estate Transfer Tax Calculator. To view the Revenue Tax Calculator click here. The calculation is based on 160 per thousand with the first 500 being exempt.

The tax is paid to the county recorder in the county where the real property is located. Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 50000 is exempt.

Real Estate Transfer Tax Calculator. What is Transfer Tax. You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first 500 is exempt.

Do not type commas. This calculation is based on 160 per thousand and the first 500 is exempt. Enter the amount paid in the top box the rest will autopopulate.

Real Estate Transfer Tax Calculator. This calculation is based on 160 per thousand and the first 500 is exempt. Monroe County Iowa - Real Estate Transfer Tax Calculator.

You can also find the total amount paid by entering the revenue tax stamp paid. This calculation is based on 160 per thousand and the first 500 is exempt. Do not type commas or dollar signs into number fields.

This calculation is based on 160 per thousand and the first 500 is exempt. You may calculate real estate transfer tax by entering the total amount paid for the property. The tax is imposed on the total amount paid for the property.

The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property. You can also find the total amount paid by entering the revenue tax stamp paid. Total Amount Paid.

You can also find the total amount paid by entering the revenue tax stamp paid. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. Calculate the real estate transfer tax by entering the total amount paid for the property.

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate. Calculate the real estate transfer tax by entering the total amount paid for the property. Type your numeric value in the Total Amount Paid field to calculate the total amount due.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. Iowa Real Estate Tax tables. Real Estate Transfer Declaration of.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. This calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 500 is exempt.

The tax is imposed on the total amount paid for the property. Real Estate Transfer Tax Calculator.

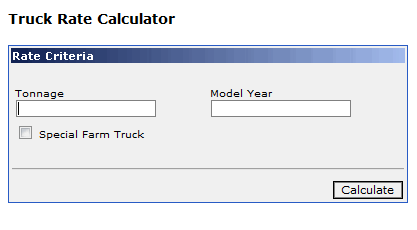

Dmv Fees By State Usa Manual Car Registration Calculator

Stock Yield Calculator In 2022 Slide Rule Math Stock Exchange

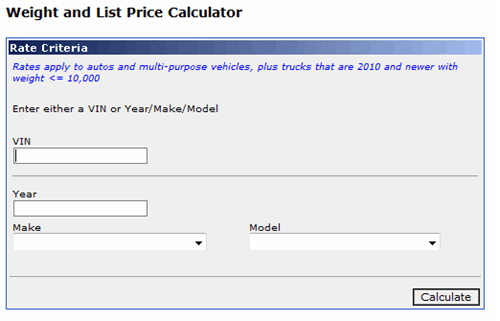

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Should You Move To A State With No Income Tax Forbes Advisor

Calculate Your Transfer Fee Credit Iowa Tax And Tags

2021 Capital Gains Tax Rates By State

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

A Breakdown Of Transfer Tax In Real Estate Upnest

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Transfer Tax Calculator 2022 For All 50 States

Sales Tax Calculator Credit Karma

Unemployment Insurance Rate Information Department Of Labor