car lease tax deduction hmrc

Only this classification of charity is eligible to offer official tax deductions for vehicle donations. You lease an electric car for 6000 over the 2022-23 financial year.

Tax Benefits Of Business Car Leasing

Is leasing a vehicle tax deductable.

. Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when youre. You deduct the cost against profits. 267Aa stipulates that for a.

Conversely the new provision may disallow interest deductions in some arrangements that do not result in a mismatch. For more information about tax on company cars visit the HM Revenue Customs HMRC website. With a car lease you can claim your monthly payments as a business expense meaning you can reclaim a percentage of VAT depending on the ratio of personalbusiness.

In other words 15 percent of the expense is not allowable for tax purposesOf course your running costs of the car include insurance and tax and these are deductible expenses under. Contract hire and leasing is a tax efficient way in which they can operate a fleet. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or.

Find our what percentage of the FMV fair market value you will be able to claim on taxes. The auto lease inclusion is netted against the amount of the lease payment. In certain cases the deduction for the cost of hiring a car which can be made in calculating the profits of a trade is restricted.

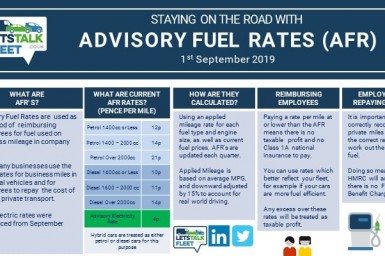

For vans and pickups there is a standard bik amount currently set at 3430 which you will pay at your effective tax band rate usually either 20 or 40 co2 gkm. For a vehicle that emits less than110gkm of CO2 100 of the monthly rentals are allowable against corporation. A 15 restriction applies to cars with CO2 emissions of more.

Only this classification of charity is eligible to offer official tax deductions for vehicle donations. Find our what percentage of the FMV fair market value you will be able to claim on taxes. As corporation tax is 19 then your tax savings are calculated as 19.

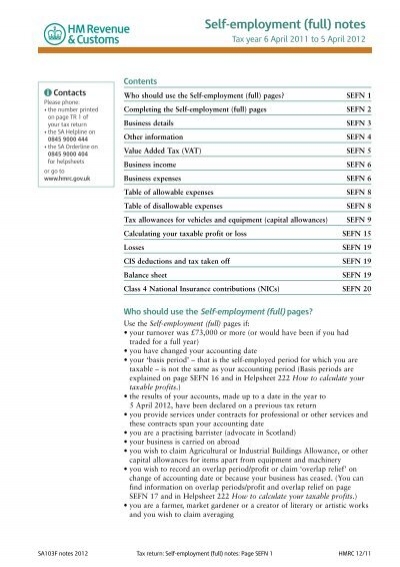

In order to make tax deductions on a leased car you need to submit a final VAT return form to HMRC which can be done either online or via compatible accounting software.

Is Leasing A Car Tax Deductible Money Donut

Lease Rental Restriction Letstalkfleet

Should I Lease A Car Through My Limited Company Or Personally

Limited Company Cars Company Car Tax Basics Uk Youtube

An Employer S Guide To Car Allowance Travelperk

Are Car Repairs Tax Deductible H R Block

How To Deduct Car Lease Payments As An Llc

Is It Better To Buy Or Lease A Car Taxact Blog

Electric Cars For Business Tax Leasing Costs And Charging Explained Drivingelectric

Are Car Lease Payments Tax Deductible Lease Fetcher

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Self Employment Full Notes Hm Revenue Amp Customs

Company Car Tax Bands 2022 2023 Everything You Need To Know Autocar

Car Or Van Hmrc Tax Rules Ttr Barnes

Would It Be More Beneficial If I Leased A Car Through My Limited Company Macalvins

V188 Fill Out Sign Online Dochub

Should I Lease A Car Through My Limited Company Or Personally

Simple Tax Guide For American Expats In The Uk

Leasing Electric Cars What Are The Tax Benefits Thp Accountants